Buying Property through Super (SMSF) in Victoria — Key Things to Know

Written by Lawrence Liang - 02 January 2026

Buying property through your Self-Managed Super Fund (SMSF) remains a popular wealth-building tool — because it allows investors to use their retirement savings to acquire quality assets such as residential and commercial property. Whether it’s an apartment in South Melbourne or a house in Geelong, SMSF property investment offers flexibility and puts you in control of your investment portfolio.

But buying property through super is not the same as buying in your personal name. The purchase must comply with the strict requirements of the Superannuation Industry (Supervision) Act 1993 (Cth) (SIS Act) and meet the ATO’s trustee obligations at all times. When there is borrowing involved, the transaction must be structured as a limited recourse borrowing arrangement (LRBA) under Section 67A of the SIS Act. This structure must be correct from day one — if not, it can lead to contract issues, lender delays, or even additional stamp duty under the Duties Act 2000 (VIC).

This guide explains how SMSF property purchases work, and what you need to watch out for from a conveyancing perspective including:

How Do You Buy Property through an SMSF?

An SMSF can buy property provided strict superannuation laws are followed. These rules exist to ensure your super is used only for retirement purposes.

The property must meet all of the following rules:

Sole purpose test

The property must be purchased solely to provide retirement benefits to SMSF members.No related-party acquisition (with limited exceptions)

Residential property generally cannot be bought from a related party.

Commercial “business real property” may be acquired from a related party if conditions are met.No personal use

The property must not be lived in by SMSF members, their relatives or any related parties.No related-party leasing (residential)

Residential property cannot be rented to members or their family.

An SMSF can usually buy commercial property and lease it to a related business at market rent. This is common for small business owners and must be properly documented.

More details can be found here.

Different Structures - Buying Outright vs Buying with Borrowing

Buying outright (no loan needed)

If your SMSF buy the property outright – meaning the SMSF has sufficient funds to pay for the property and all the associated costs, you will need to set up SMSF and a trustee company (if you prefer to use a corporate trustee). Although you may use an individual trustee, it is recommended to set up a corporate trustee for it.

Buying with a loan (LRBA)

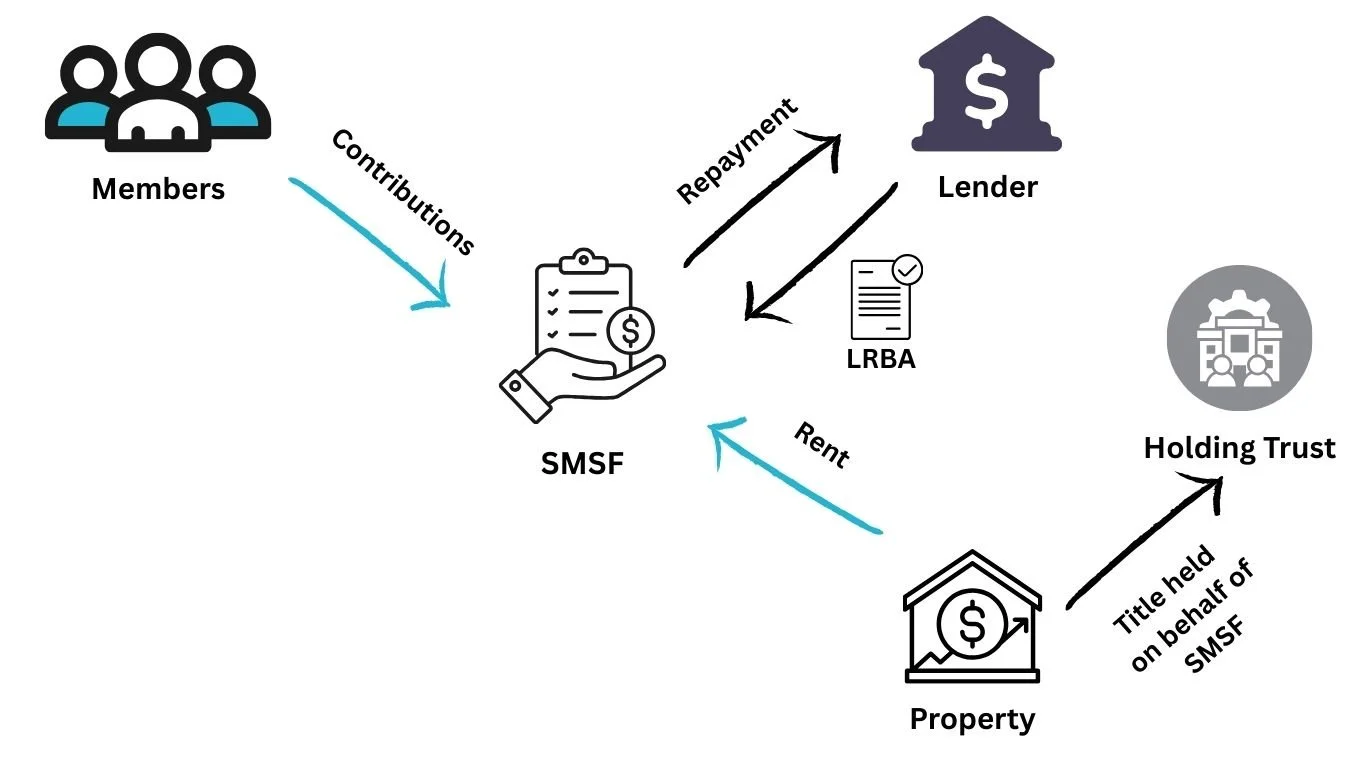

If your SMSF requires loan to purchase the property, then in addition to set up the SMSF, you will also need to set up a bare trust (also known as custodian trust). This enables the SMSF to borrow to purchase a property – something it can only do under a limited recourse borrowing arrangement (LRBA). the property is held by the bare trust on behalf of the SMSF.

The following diagram shows the structure with a bare trust set up:

How Much Can an SMSF Borrow?

An SMSF can borrow to purchase property under a limited recourse borrowing arrangement (LRBA). A key difference is that loan servicing is assessed outside your personal name — meaning even if you are at maximum borrowing capacity personally, your SMSF may still be able to borrow, provided the fund’s income and contributions are sufficient to meet the repayments. Major banks have exited SMSF lending — so lending options depend on non-bank lenders with stricter documentation and timelines.

General rule of thumb:

Residential - Up to 80%, although some lenders will lend above 80%.

Commercial - 65–70%

Rural / farm - Often capped at 50% and location dependent

It is better to engage a mortgage broker experienced in SMSF purchase to ensure a smooth process.

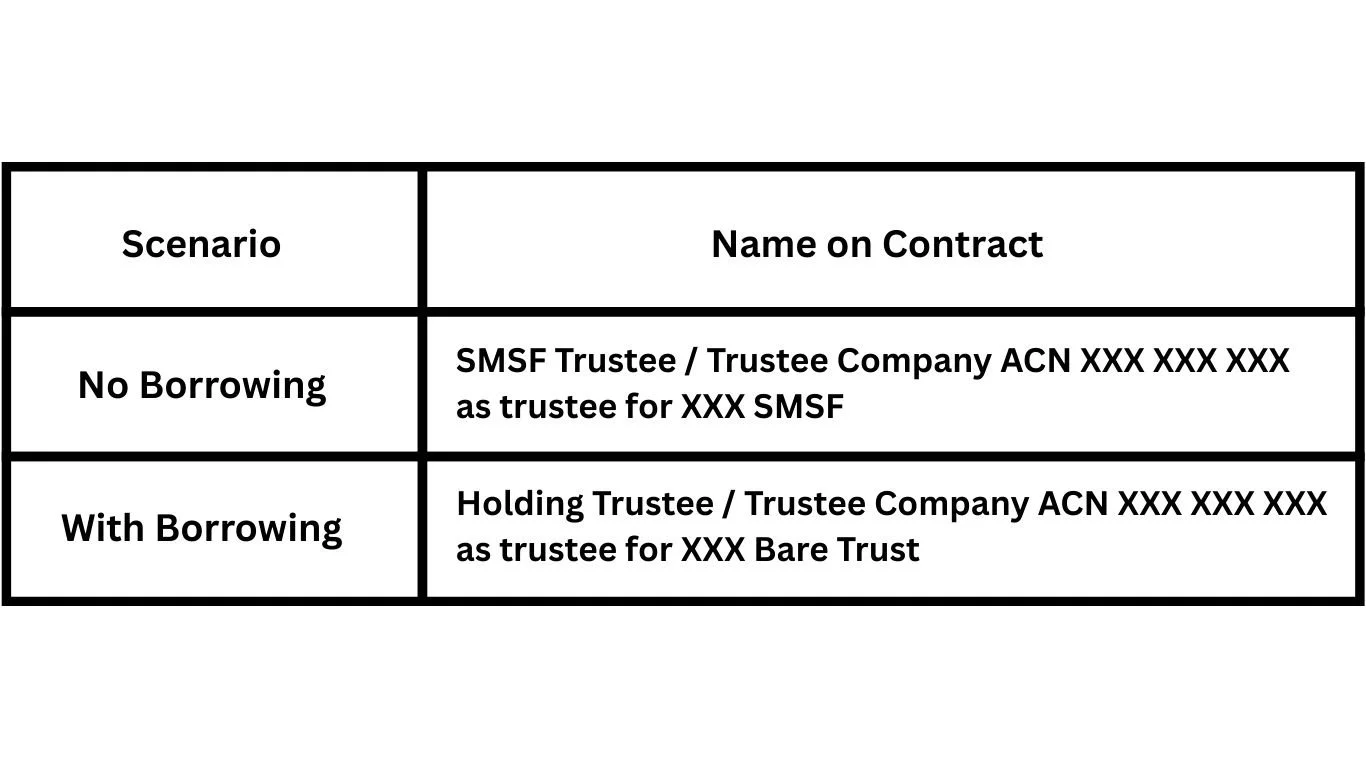

What Name Should You Put on the Contract of Sale?

Different States have different requirements on the name.

In Victoria, the purchaser name on the Contract of Sale depends on whether the SMSF is borrowing:

The holding trustee company must be established before signing a contract where a loan will be used.

Although you may still be able to nominate the correct entity in Victoria via nomination form, it is recommended to have the correct names on contract to avoid problems it can create when the lenders’ solicitors verify the documents for settlement or incur additional legal fees.

Due to the complex structure, it usually takes longer to set up and complete the SMSF property purchase, so please start the preparation early and allow enough time under the contract of sale for settlement.

Purchasing property through your SMSF?

Don’t leave your retirement to chance. Leverage 10+ years of conveyancing experience to safeguard your SMSF investment. Get your quote today.